does florida have capital gains tax on real estate

You may owe capital gains taxes if you sold stocks real estate or other investments. Heres an example of how much capital gains tax you might pay if you owned the house for more or less than 12 months.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The two year residency test need not be.

. No one says you have to rent the property out to long-term tenants. If you have any questions contact JC Realty Group at 877-531-1555. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

This amount increases to 500000 if youre married. Florida also imposes a six percent sales tax on any rental property income for periods less than six months as well. There is no inheritance tax or estate tax in Florida.

Make sure you account for the way this will impact your future profits which will have an impact on your capital gains tax when you sell. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years. For most people the capital gains tax does not exceed 15.

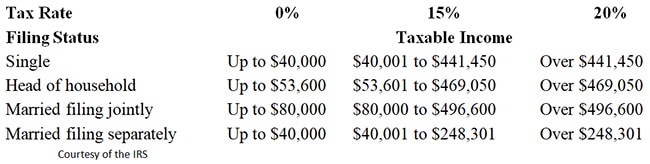

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. Convert Your Home into a Short-Term Rental.

The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple. An exception is Miami-Dade County where the rate is. We can help you understand the rules and make sure that you pay the least amount of taxes possible.

60 per 100 or portion thereof when the property is a. People also ask what is the capital gains tax rate in Florida. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

Its called the 2 out of 5 year rule. If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15. Long-term capital gains on the other hand are taxed at either 0 15 of 20.

Section 22013 Florida Statutes. As a full-service real estate firm JC Realty Group is here to help you with all of your needs when it comes to capital gains on Florida real estate. 250000 of capital gains on real estate if youre single.

The IRS typically allows you to exclude up to. Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. 500000 of capital gains on real estate if youre married and filing jointly.

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. These come in the form of capital gains taxes. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021.

Special Real Estate Exemptions for Capital Gains. If your taxable income is less than 40400 for single filers or 80800 for married filing jointly your long-term capital gains tax rate is 0. At 22 your capital gains tax on this real estate sale would be 3300.

Ncome up to 40400 single80800 married. You have lived in the home as your principal residence for two out of the last five years. Income over 445850501600 married.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer. That goes doubly when you can avoid capital gains taxes on the first 250000 or 500000 in profits.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. There are however some restrictions on this exemption. Individuals and families must pay the following capital gains taxes.

The Three Types of Florida Real Estate Taxes. Run the numbers to calculate how it would perform as a vacation rental on Airbnb instead. You can maximize this advantage by frequently moving homes.

If you are in the 396 bracket your long-term capital gains tax rate. Your primary residence can help you to reduce the capital gains tax that you will be subject to. If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15.

The State of Florida does not. The state taxes capital gains as income. Take advantage of primary residence exclusion.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. The tax rate for documents that transfer an interest in real property is. The capital gains tax rate for tax year 2020 ranges from 0 to 28.

To determine how much you owe in capital gains tax after selling a. The formula for calculating capital gains tax for real estate will work similarly for any other asset with slight intricacies that will be covered later. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

Let us first calculate the capital gains made on on your real estate investment. Income over 40400 single80800 married. This is often referred to as.

Capital Gains Tax What Is It When Do You Pay It

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

What Is Capital Gains Tax And When Are You Exempt Thestreet

Solved Can You Avoid Capital Gains Taxes On A Second Home

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax On Real Estate And How To Avoid It

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Capital Gains On Real Estate Investment Property Works

How To Calculate Capital Gains Tax On Real Estate Investment Property Youtube

How Much Tax Will I Pay If I Flip A House New Silver

Florida Real Estate Taxes What You Need To Know

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The States With The Highest Capital Gains Tax Rates The Motley Fool

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Real Estate Capital Gains Calculator Internal Revenue Code Simplified